Understanding President Trump’s 2025 Reciprocal Tariffs

On April 2, 2025, U.S. President Donald Trump announced what he termed "Liberation Day" and imposed massive reciprocal tariffs on imports from several nations. Intended to redress trade imbalances and strengthen American economic interests, this bold action signaled a major departure from established free trade practices.

Understanding Reciprocal Tariffs

Definition

A reciprocal tariff is a countermeasure applied by a nation when another country imposes high import duties on its exports. This tit-for-tat approach is intended to restore fairness in trade relations and compel trading partners to lower their barriers.

Purpose

Beyond raising government revenue, reciprocal tariffs serve as strategic tools in global trade diplomacy. They are used to influence foreign policy, protect domestic markets, and negotiate better trade deals.

Comparison with Other Tariffs

Unlike general customs duties or anti-dumping tariffs, which focus on shielding local industries from unfair competition or dumping, reciprocal tariffs directly respond to the trade policies of specific nations.

What Are Tariffs?

Definition

Tariffs, also known as customs duties, are taxes imposed on goods entering or exiting a country—primarily on imports. They are often employed to regulate trade flows, protect industries, and generate revenue.

Example

If the U.S. imports steel from India or smartphones from China, applying a tariff increases their price, making domestic alternatives more attractive.

Strategic Uses

Governments may use tariffs to support innovation, promote startups, and reduce dependency on cheap imports, aligning with long-term industrial strategies.

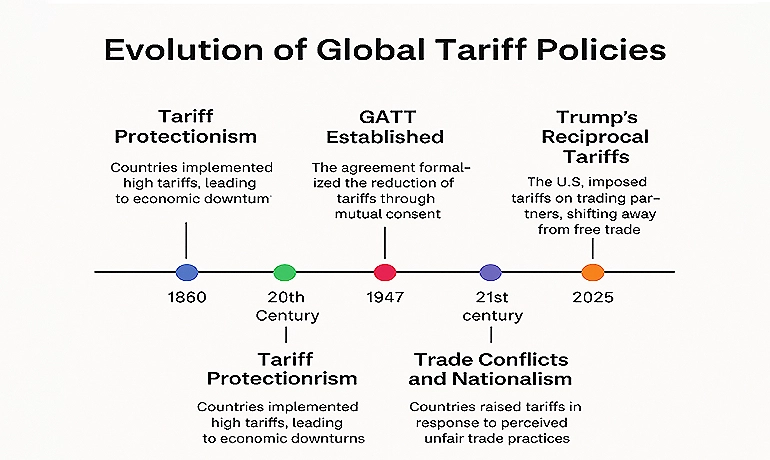

Historical Context and Evolution

19th Century Protectionism

Early tariffs were designed to shield budding industries from foreign competition. Reciprocal tariffs emerged as a way to reward cooperative partners or penalize adversaries.

The Cobden-Chevalier Treaty (1860)

This agreement between Britain and France was a milestone in trade policy, proving that mutual tariff reductions could benefit both economies.

Smoot-Hawley and the Great Depression

The U.S.'s Smoot-Hawley Tariff Act of 1930 prompted retaliation from other countries, severely shrinking global trade and worsening the Great Depression.

Post-War Reforms and GATT

To avoid repeating past mistakes, world leaders created the General Agreement on Tariffs and Trade (GATT) in 1947, establishing a platform for cooperative tariff reductions.

Modern-Day Nationalism

In recent decades, particularly during Trump's earlier term, the U.S. re-embraced tariffs, citing unfair trade practices and seeking to rebalance relationships with major partners like China and the EU.

How Reciprocal Tariffs Are Implemented

Strategy

The goal is to reduce trade deficits with specific countries. The process involves identifying problematic trade partners, analyzing barriers, and imposing targeted tariffs ranging from 0% to 99%.

When Are They Applied?

Reciprocal tariffs are triggered when another country’s policies—such as currency manipulation, tax breaks, or regulatory hurdles—are seen as directly contributing to an unfavorable trade imbalance.

Calculation Framework

Determining the appropriate tariff requires examining.

- Determining the appropriate tariff requires examining.

- Passthrough effects (how much of the tariff affects consumer prices)

- Total import-export values

For example, if the U.S. wishes to apply a tariff on Country X, it considers how much trade would decline, how prices might shift, and whether the new rate would close the trade gap.

Claimed Benefits of Reciprocal Tariffs

Trade Balance Correction

They help offset one-sided trade relationships and push foreign governments toward fairer practices.

Negotiation Leverage

Tariffs can be powerful bargaining chips during trade talks, compelling countries to revisit and revise unfavorable agreements.

Domestic Industry Support

By raising the cost of imported goods, these tariffs can make local alternatives more competitive, stimulating production and safeguarding jobs.

Economic Patriotism

They reinforce a sense of national self-reliance and pride by promoting domestic manufacturing and reducing dependence on imports.

Drawbacks and Criticisms

Global Trade Reduction

Reciprocal tariffs often provoke retaliation, resulting in a drop in exports and overall trade volume.

Potential for Trade Wars

If escalated, such policies can lead to prolonged economic conflict, disrupting markets and diplomatic relations.

Higher Consumer Prices

Imported goods become more expensive, reducing affordability and consumer choice.

Supply Chain Disruption

Global supply chains rely on seamless cross-border movement. Tariffs can delay shipments, raise costs, and limit access to raw materials or components.

Long-Term Economic Risk

While short-term benefits may arise, overuse of tariffs can erode investor confidence and destabilize key sectors.

Trump’s 2025 Reciprocal Tariff Policy – Key Details

- Announced April 2, 2025, with implementation from April 5.

- Imposed a base 10% tariff on all imports under IEEPA powers

- Specific higher tariffs for countries with alleged trade barriers:

China: 54%

India: 26%

European Union: 20%

Japan: 24%

Taiwan: 32%

- Exemptions included essential imports like pharmaceuticals, semiconductors, and minerals unavailable in the U.S.

- A direct 25% tariff was placed on imported vehicles, prompting auto companies to revise pricing or halt shipments.

Impact on India

| Sector | Pre-Tariff U.S. Import Tariff (%) | Post-Tariff (Reciprocal) (%) | Potential Impact |

|---|---|---|---|

| Textiles & Apparel | 7.5% | 20% | Reduced competitiveness; potential job losses in textile hubs |

| Pharmaceuticals | 0–2.5% | 10% | Price-sensitive generics may lose ground to local U.S. producers |

| Automobile Parts | 2.5% | 15% | Supply chain disruption; Indian SMEs may lose U.S. market share |

| Information Tech | 0% | 0% (unchanged) | Largely unaffected; protected under WTO IT Agreement |

| Jewellery & Gems | 6.5% | 12% | The luxury segment may decline due to cost-sensitive American buyers |

| Agricultural Products | 5% | 18% | Sharp drop in exports of rice, spices, and organic produce |

Short-Term Effects

India’s trade structure differs significantly from that of the U.S., limiting the short-term fallout. For example, if the U.S. imposes tariffs on goods India doesn’t export—like pistachios—there’s little immediate effect.

Sectors Under Pressure

Industries such as electronics, automobiles, and textiles may feel the pinch due to the 26% tariff, raising costs and affecting market share.

Resilient Exports

Key exports like pharmaceuticals and energy products are exempt, providing some relief.

Currency and Import Implications

Increased imports of U.S. energy and defence products may strengthen the dollar and weaken the rupee, making imports costlier.

Domestic Market Dynamics

Wealthy Indian consumers might opt for now-cheaper U.S. goods, potentially undercutting local brands and posing challenges to the 'Atmanirbhar Bharat' initiative.

Possible Policy Adjustments

India may consider easing tariffs on selected U.S. products—like gems or auto parts, to maintain trade harmony and prevent further escalation.

Conclusion

Reciprocal tariffs are a double-edged sword—capable of protecting domestic interests but also risking global friction. The Trump administration’s renewed focus on this policy signals a return to hard-line trade tactics. For countries like India, the road ahead will require careful balancing between economic diplomacy and national priorities.

As businesses navigate the complexities of these evolving trade policies, Sarvam Logistics stands ready to offer complete logistics solutions . With our expertise in global supply chains and cross-border operations, we help businesses mitigate the challenges posed by tariffs and maintain smooth trade flows. Trust Sarvam Logistics to guide you through these uncertain times and keep your operations on track.